Options for Achieving the Strategic and Operational Imperatives of Call Centers

Marketing leaders understand the strategic importance of call centers. High-quality call centers build patient loyalty and drive increased provider utilization rates. Which option is best?

// By Yuriy Kotlyar //

The explosion of digital health tools for communicating with patients can make call centers seem like yesterday’s news. Of course, experience shows health care marketing leaders the strategic value of a high-functioning, efficient call center.

The explosion of digital health tools for communicating with patients can make call centers seem like yesterday’s news. Of course, experience shows health care marketing leaders the strategic value of a high-functioning, efficient call center.

Many patients enjoy the conveniences of digital communication tools — self-scheduling, receiving test results and appointment reminders, researching specialists — when those tools can solve their problem. But even digitally savvy patients often need human assistance. They need help navigating the widening array of care options. They also need answers to myriad questions about their financial responsibility, insurance coverage, pre-authorizations, and other complex issues.

Helping patients answer these questions helps them get the care they need, improves the care experience, and builds loyalty. Call centers can also drive revenue by matching patient demand with provider capacity.

To achieve these strategic goals, health system marketing leaders must be prepared to take on the significant operational challenges of call centers. Here, we detail the challenges of an owned-and-operated (O-and-O) call center and then consider how three alternatives — outsourced management, a hybrid model that adds outside capacity to an O-and-O call center, and a fully outsourced call center — address those challenges.

Operational Challenges of O-and-O Call Centers

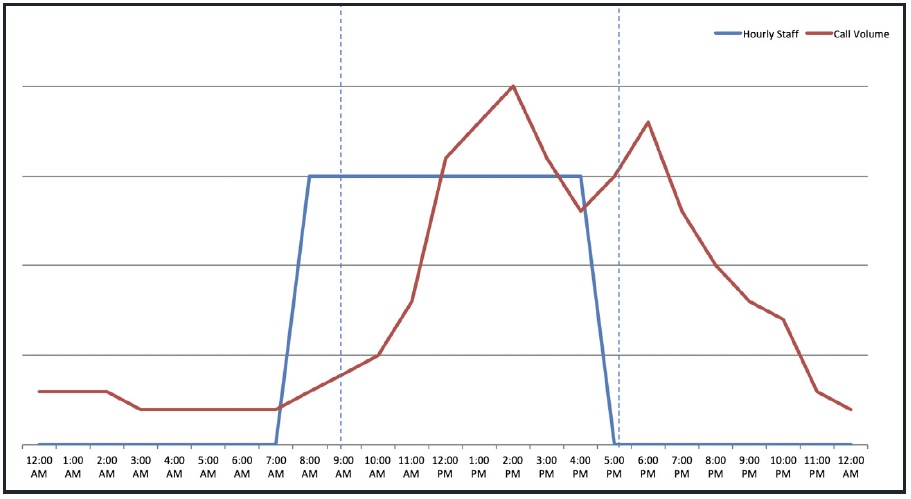

Health system call centers need to answer patient calls in a timely manner at all hours, 365 days a year. In-market call centers struggle to achieve this because call center capacity doesn’t match demand from patients (see figure 1).

Health system call center staffing capacity (blue line) is often mismatched to call volume (red line), with agents underutilized at certain times of the day, and demand that is too high at other times.

Most agents will want to work during business hours — roughly 7 a.m. to 5 p.m. on weekdays — in your market. That leads to significant underutilization in the morning, a shortage of capacity in the afternoon, and no capacity during the early-evening secondary peak.

Health system call centers struggle to cover evening hours because of competition for qualified agents from call centers that are open only in the 7 a.m. to 5 p.m. window.

A strategy that relies on finding and training new agents is an expensive proposition. Recruiting and training costs are high, and once trained, there is nothing stopping these agents from moving to other call centers. Also, the constant responsibility to train newcomers strains highly qualified agents, increasing turnover. Call centers already face an average turnover rate of 18 percent.

Concentrating your agents in a few in-market physical locations also affects availability, as having just a few locations makes your call-center service more susceptible to technical or weather-related outages. These physical locations, and the technology you need to run a call center, also represent significant capital costs.

Moreover, call centers are a fundamentally different business from providing health care services. Leadership bandwidth is a finite resource that may be better deployed on care delivery.

Outsourcing Management

Outsourcing management of a health system’s in-market call centers is an option that solves some of these challenges. The management vendor will take on the ongoing capital needs and the burden of recruiting, training, and retaining agents. A vendor brings deeper management expertise, managing call centers for multiple health systems. A management vendor may also leverage its scale to deploy better technology than a stand-alone health system can justify.

The initial transition is usually smooth. All current employees keep their jobs, albeit employed by the vendor instead of the health system. This switch may offer the agents better career paths as supervisors, managers, or trainers, and the vendor’s employee policies and benefits may appeal more to agents than policies and benefits designed for frontline health care workers.

On the other hand, this option may cost the same or even more than the current O-and-O call center. The vendor will have to wring a lot of savings out of the same operation to earn its expected profit margin and still provide a similar cost to a health system.

Hybrid Model

Another option is to select a vendor that can provide added capacity to a downsized O-and-O call center. In the hybrid model, a vendor supplements capacity during peak hours and handles all calls during off hours. This arrangement enables a health system to better support patients 24 hours a day, as peak wait times in early afternoon are reduced and support is added outside of the 7 a.m. to 5 p.m. window. The vendor capacity offers cover for absenteeism, short-term recruiting and retention challenges, and technical or weather-related outages.

Adding outsourced capacity while maintaining an O-and-O call center is not likely to reduce operating costs. Not enough of the costs of the O-and-O call center can be removed to offset the cost of adding the capacity. One cost benefit is that, with a flexible vendor as backup, a health system may capture some operating benefit from not having to overstaff as a hedge against occasional periods of higher call volume or agent turnover.

Importantly, a health system can still come out ahead with this arrangement by achieving the strategic imperatives of better serving patients through the call center — improving patient experience and loyalty and increasing provider utilization.

Fully Outsourced Call Centers

A fully outsourced call center vendor operates virtually, with agents working from their own homes. This option yields two benefits that outsourced management and the hybrid model struggle to provide: a more consistently high level of service, and operating cost savings.

Quality

A full-service vendor can provide better quality based on two capabilities: flexing capacity to call demand and deploying better technology that eliminates dropped calls. A vendor achieves these benefits from greater scale of operations and deeper management expertise. Better service translates into lower abandon rates for calls and fewer no-shows as a health system is more effectively communicating with patients. Both of these service outcomes help achieve the strategic goals of the call center function within a health system.

In addition, full-service virtual call center agents are dispersed geographically, offering service that is available 24 hours a day, every day, and is never significantly impacted by inclement weather, natural disasters, regional technical outages, or unanticipated local events.

Cost Savings, Increased Revenue

A full-service, outsourced virtual patient communication function delivers significant savings by improving operator utilization rates. An in-house call center’s inflexible capacity, concentrated in the 7 a.m. to 5 p.m. window, leads to average utilization rates as low as 30 percent. An outsourced, dispersed call center can nearly triple operator utilization to an average of 85 percent.

Full-service outsourced vendors also benefit from economies of scale in technology, recruitment, and training. Having more experienced agents also drives revenue, through more consistent application of insurance verification and upfront collection of patient co-pays.

And because vendors save on the overhead of having physical call centers, they can offer more favorable terms to health care organizations. All of these operating efficiencies together allow full-service vendors to provide services at a price that beats the cost of a health system operating its own call center or outsourcing management to a vendor.

Staying in the Driver’s Seat

Even as digital tools expand and improve what they can achieve for patients, marketing leaders understand the strategic importance of call centers. High-quality call centers build patient loyalty and drive increased provider utilization rates.

But owning and operating a call center brings significant financial and operational challenges that health systems are not usually well equipped to handle. Marketing leaders must weigh the benefits, costs, and risks of owning and operating a call center in comparison with the three main alternatives. Solving the financial and operational challenges will ensure that marketing leaders continue to be in the driver’s seat to shape the consumer aspects of building loyalty with patients.

Yuriy Kotlyar is co-founder and CEO of American Health Connection, an all-inclusive healthcare call center provider.