High-Value Health Care Consumers, Part 1: Who They Are and How They Impact Revenue

// By Paula Serios //

Some companies decide what product or service they want to sell and then use marketing to find people to buy it. Smart companies figure out what problems people face and how they want them solved, then create distinctive products and services to solve them.

Some companies decide what product or service they want to sell and then use marketing to find people to buy it. Smart companies figure out what problems people face and how they want them solved, then create distinctive products and services to solve them.

The human-centric approach to developing products and services not only determines what people want, how they want it, and where they want it but also breeds category disruption as the new normal.

Take ride hailing as an example. Taxis are expensive but for decades were the only alternative to public transportation for door-to-door rides. Hello, Uber and Lyft. Door-to-door conveniently located on your phone at a much lower cost.

And in hospitality, enter Airbnb. Often at a fraction of the cost, stays away from home are now offered in the more intimate setting of a local homeowner.

And finally, in retail, we have the gold standard in personal shopping services such as Nordstrom’s challenged by the likes of Stitch Fix’s personalized clothing selections delivered right to your door with customized price points and no-fuss returns.

Each of these disruptors did the same thing: They discovered the problem consumers wanted solved, and developed and marketed a distinct, frictionless service to solve that problem. Their services spoke to human beings and their needs, and they were rewarded with rapid growth and loyal, high-value customers.

Health care is ripe for this kind of consumer-centric approach, and high-value consumers are an attractive cohort to target, with more health encounters per year, and the highest per-encounter value.

Clinical considerations are critical for proper medical treatment, but for too long, consumers’ diseases or body parts have been at the center of the service design process. Numerous studies show that how patients feel about their care experience has a tangible impact not only on their healing but also their advocacy and loyalty afterward.

As health care embraces this age of consumerism, applying a human-centric approach will be imperative. Understanding people’s health care issues and how they want them solved will be fundamental to success and a direct path to high-value health care consumers.

“Numerous studies show that how patients feel about their care experience has a tangible impact not only on their healing but also their advocacy and loyalty afterward.”

In a proprietary national study fielded in collaboration with NRC Health, BVK discovered something both compelling and actionable about high-value consumers in health care and the problems they are seeking to solve. The findings were so surprising to us that we repeated and expanded the study to confirm our initial findings. The high-value health care consumers are actually Innovators and Early Adopters who look nothing like what we expected.

Employing the Diffusion of Innovations Theory developed by E. M. Rogers, which explains how an idea or product gains momentum and spreads through a specific population or social system,1 BVK sought to understand health care Innovators and Early Adopters and how their behavior might impact their motivations, personal behavior, and the health care services they use and access.

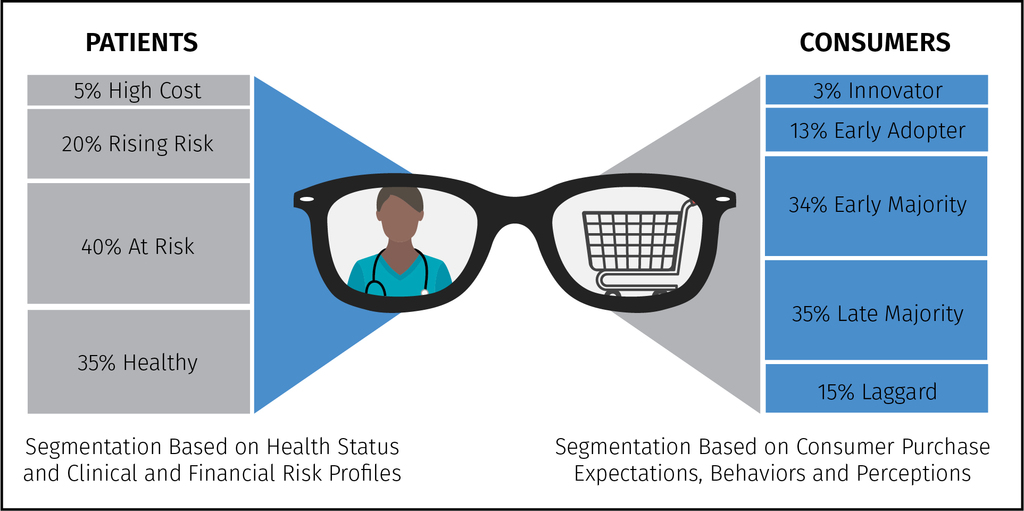

This shift from patient to consumer segmentation shed new light on high-value health care consumers.

Moving from patient segmentation based on health status and financial risk to consumer segmentation based on purchase expectations, behaviors, and perceptions identified Innovators and Early Adopters as key targets.

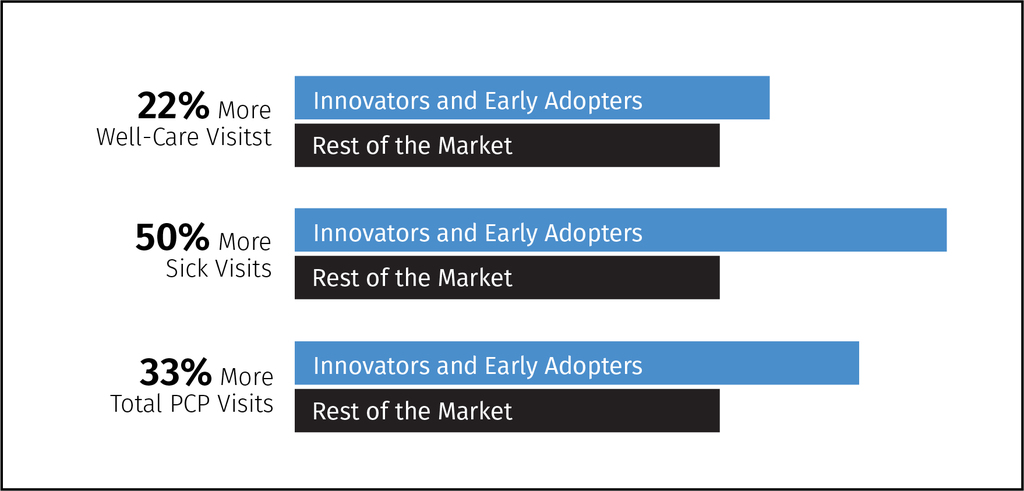

The Innovator and Early Adopter cohorts are on average:

- Younger: 38-41 years old

- Married with children: 59 percent married with 34 percent having children

- Well-educated: 65 percent have at least a college degree

- High-income: More than $75,000 annual household income

- Employed: More than 61 percent have full-time jobs

- Commercially insured: More than 93 percent have health insurance

High-value consumers proactively make decisions on treatment, terms of service, and providers, and take ownership for meeting their health care needs. They are driven by different behaviors than patients of the past; they actively shop for health care services and seek self-managed and self-service experiences.

“The high-value health care consumers are actually Innovators and Early Adopters who look nothing like what we expected.”

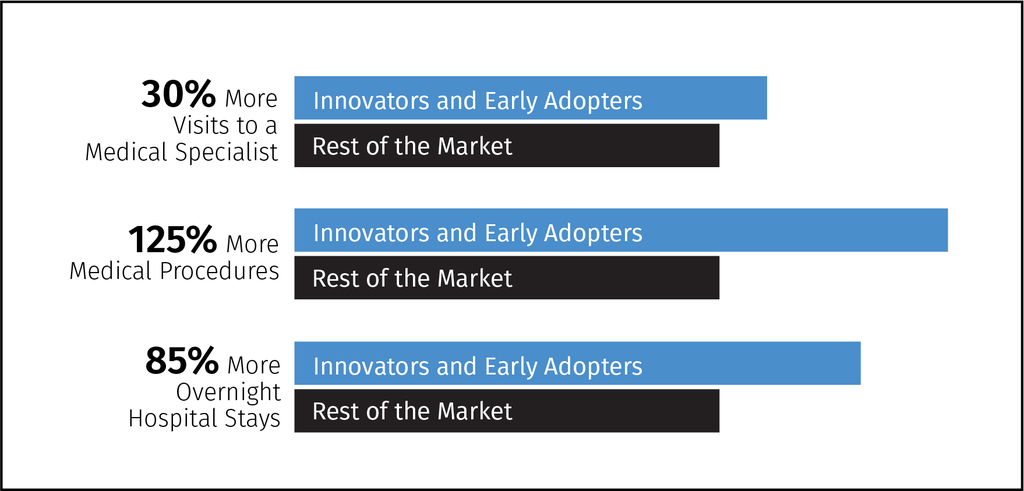

What is most surprising is that they self-report as very healthy while consuming more health care each year than the other cohorts. They view themselves as very healthy because they care for themselves and that includes using health care extensively in a preventive or preservative way. They average 128 percent more health care encounters each year and based on their insurance type and specific health care needs, they are most likely to have the highest per-encounter value.

OUTPATIENT ENCOUNTERS

INPATIENT ENCOUNTERS

Their influence is substantial, impacting every other cohort with active and wide promotion of their health care choices within their personal networks and on social media. Early Adopters’ credibility is anchored on their authority, knowledge, social position, and relationship to others, which makes them role models. As such, they realize they must make judicious choices to maintain their esteemed position in the overall fabric of the larger social system.

Early Adopters, in particular, seek a single health care solution that provides orchestration and satisfaction of their needs. And they are willing to pay a premium and reward the provider with loyalty for a job well done for as long as it is done well.

66 percent of Innovators and Early Adopters believe it is important to get all of their care and treatment from one provider organization

40 percent are willing to pay over $100 more in premiums to keep their preferred doctors and hospitals in network.

The Value of Innovators and Early Adopters

So now we know that Innovators and Early Adopters

- consume more health care services

- are younger, so they consume more health care over a longer period of time

- are brand loyal and willing to pay more for a loyal partner

- are influential and actively promote their choices

We developed an algorithm that quantified the lifetime value of Innovators and Early Adopters and took a deep look at the bottom-line impact of building a targeted base. Here’s what we found for the northeastern region of the U.S.:

|

Cohort |

Avg Annual Revenue/Person |

| Innovators |

$13,852 |

| Early Adopters |

$6,998 |

| Early Majority |

$6,093 |

| Late Majority |

$6,765 |

| Laggards |

$5,196 |

If you attract just 10 percent more Innovators and Early Adopters annually, your bottom-line impact would be $100,000 in revenue per 1,000 patients. Twenty percent adds up to $250,000 per 1,000 patients. At 25 percent more Innovators and Early Adopters, the story exponentially increases, with a $650,000 gain in revenue per 1,000 patients.

Real revenue and bottom-line impact are achieved by shifting to targeting the consumers who consume the most health care and influence others to do as they do.

In Part 2 of this two-part series, we will look at the best ways to reach this high-value cohort.

Paula Serios is senior vice president, BVK Health. She brings a holistic perspective of more than 25 years of agency, corporate marketing, and consulting experience to health and service industries. Described as a “disruptor for the greater good,” she unearths clarity and results-driven solutions to complex marketing and business problems in life-changing categories.