Riverview Health Expands with Freestanding ER & Urgent Care Facilities

// By Jane Weber Brubaker //

If your health system is in a geographic region experiencing rapid growth, it makes sense to capitalize on that trend and expand right along with the population. Hamilton County, a suburb of Indianapolis, is “growing by leaps and bounds,” according to Seth Warren, president and CEO of Riverview Health.

If your health system is in a geographic region experiencing rapid growth, it makes sense to capitalize on that trend and expand right along with the population. Hamilton County, a suburb of Indianapolis, is “growing by leaps and bounds,” according to Seth Warren, president and CEO of Riverview Health.

Seth Warren, president and CEO of Riverview Health

Riverview Health’s primary location in Noblesville is a full-service, 156-bed hospital founded 110 years ago. Last year, it opened a second facility, Riverview Health Westfield Hospital, which includes “the area’s first combined emergency and urgent care center.” This new hybrid model allows patients to receive care at the appropriate level — and be billed at the appropriate level.

So it wasn’t a big leap for Warren to embrace the hybrid concept when he got a call from Intuitive Health in Texas. Intuitive Health is a commercial spinoff of Legacy ER & Urgent Care, a company that owns and operates freestanding integrated emergency and urgent care facilities in the Dallas area.

“Legacy was started in 2008 by a group of ER physicians who believed they could build more of a retail-centric model in the community,” says David Apple, chief marketing officer for both Legacy and Intuitive Health. “From day one, the mission was to operate a dual model.”

David Apple, chief marketing officer, Legacy ER & Urgent Care and Intuitive Health

What appealed to Warren was Intuitive Health’s customer-focused approach. Legacy’s Net Promoter Score, consistently in the 80s, demonstrates its commitment to service. Warren says, “Customer service is very important to us, and when they came to us and talked about their model and the customer focus, it really resonated with us.”

The two organizations have formed a joint venture and are in the process of building four freestanding emergency/urgent care (ER/UC) facilities in retail settings throughout the Indianapolis suburbs. All will be “part and parcel” of Riverview Health, Warren says.

Can this hybrid model — hospital-branded freestanding ER/UC facilities — rein in costs related to over-utilization of ER services, grow market share, and increase patient satisfaction?

Two Care Settings Under One Roof

In Texas, freestanding ERs do not have to be affiliated with a hospital. The problem is, consumers may think they’re getting treatment in an urgent care — until they get the bill and find out they’re being charged emergency care rates.

Legacy’s model was designed to address this problem. When patients in the Dallas area visit a Legacy facility, providers use objective criteria to determine whether they need urgent or emergent care, and patients are billed accordingly. “Over 80 percent of all those patients get billed and treated at the urgent care level, so we’re saving the community a lot of money here in North Texas,” Apple says.

Location, Location, Location

A key feature of Legacy’s model, which is being commercially branded as Intuitive Health, is convenience. Rather than requiring patients to travel to a hospital campus, facilities are located in high-traffic retail areas. “These facilities are going to be built in communities of high commercial pay surrounded by very well-known retail, in the same areas that customers are already doing their retail and trade,” says Apple. “Every market is different, but we look for a big anchor such as Target or Ikea, so it’s right in a retail hub.”

Riverview’s first ER/UC is being built in Fishers, Indiana, followed by facilities in north Carmel, west Carmel, and the Nora area north of Indianapolis. “We felt that we need to reach out and add more locations,” Warren says. “By doing so we’re expanding our footprint, expanding our brand, and really providing more of a hub-and-spoke model.”

Concierge-Like Services

From the beginning, Legacy understood that to attract and retain customers in a crowded market it had to provide excellent service. “One of the first realizations was that to get patients to come back and trust the care, there had to be attention to customer care,” Apple says. “We have to deliver exceptional experience at every stage of the patient journey.”

The initial partners set out to establish customer service as a cultural norm, by training the entire staff, from the front office to the nurses and ER physicians. “That grew into a pretty sophisticated process, and that’s probably the most proprietary thing we have,” says Apple. “It’s essentially meant to ‘wow’ a customer.”

The physical environment is welcoming, with no glass partitions. The initial sign-in for a new patient takes 16 seconds; for existing patients, just a signature is needed. “Our goal is to keep you moving. All those specific barriers that we all hate as consumers inside the health care system, we’ve taken out.” The entire journey for a typical urgent care patient averages 35 minutes.

Measurement and Continuous Improvement

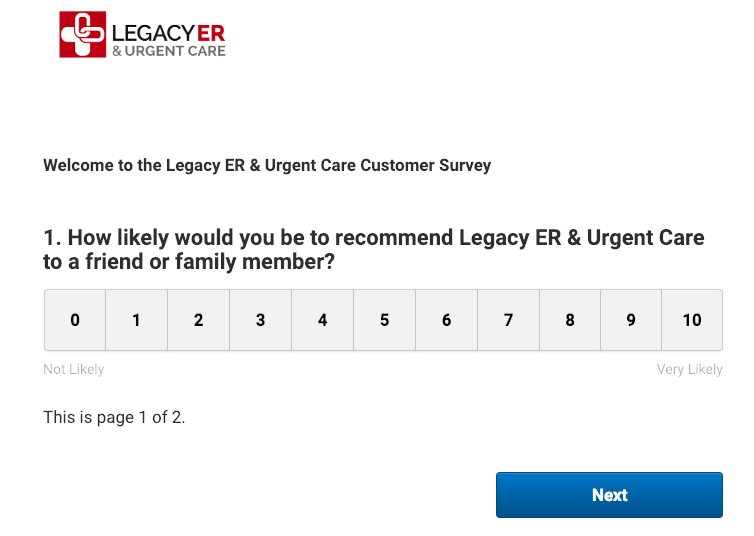

The day after receiving care, Legacy sends out an email to patients requesting feedback on their experience. The survey begins with the Net Promoter Score question: “How likely would you be to recommend Legacy ER & Urgent Care to a friend or family member?”

Net Promoter Score is used to help organizations measure customer perceptions.

NPS is calculated as follows:

Promoters (score 9-10) are loyal enthusiasts who will keep buying and refer others, fueling growth.

Passives (score 7-8) are satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

Detractors (score 0-6) are unhappy customers who can damage your brand and impede growth through negative word of mouth.

Subtracting the percentage of Detractors from the percentage of Promoters yields the Net Promoter Score, which can range from a low of -100 (if every customer is a Detractor) to a high of 100 (if every customer is a Promoter).

Source: Satmetrix

The next five questions of the survey drill down to understand how customers feel about specific aspects of their visit, including:

- Reception process

- Door-to-door time

- Nurse or technician who administered care

- Physician who administered care

- Billing procedure

“We’ve timed it hundreds of times and we make sure that it’s under 20 seconds so there’s a high incentive to fill it out,” Apple says. Legacy sees 90,000 patients a year, and the response rate to the survey is 22 to 24 percent. The resulting Net Promoter Score is in the 84-85 range, meaning that most customers who complete the survey are Promoters.

The fact that Legacy has been perfecting the process for the past 10 years was attractive to Warren. “We thought it was better for us to buy than to build in this case,” he says. “They knew how to do it, and we will be able to hit the ground running and bring that high level of care immediately. We have excellent patient care, but there’s always room for improvement, and so we’re going to learn from this and apply it in other areas of the organization.”

From a payer perspective, a care delivery model that treats patients at the appropriate level of care and avoids over-utilization of higher-cost emergency services is desirable. Warren sees the model as a door opener to discuss direct contracting with area employers seeking to better manage health care costs.

Warren expects the model to be profitable on its own and hopes that it will also drive volume for other services. “The downstream benefit to us is that we can build a relationship with this patient for their other health care needs,” he says.

Jane Weber Brubaker is executive editor of Plain-English Health Care, a division of Plain-English Media. She directs editorial content for eHealthcare Strategy & Trends and Strategic Health Care Marketing, and is past chair of the eHealthcare Leadership Awards. Email her at jane@plainenglishmedia.com.